Arizona has a hit and run problem

One Hit And Run Accident is One Too Many

On Tuesday, December 2, 2024 a teenage Tempe resident was badly injured after a hit and run accident while walking to school. While the suspect was apprehended and is in custody, this is a sober reminder that hit and run accidents happen too often and if you are not prepared, they can can cause you both physical and financial harm.

At Better Quotez, we believe our duty is to dive into what you can do to be prepared if this unfortunately happens to you. Since car insurance now can be upwards of 3% to 7% of most Arizonans annual income, it is best to speak with a qualified insurance professional to ensure that you are covered in case this unfortunate circumstance happens to you.

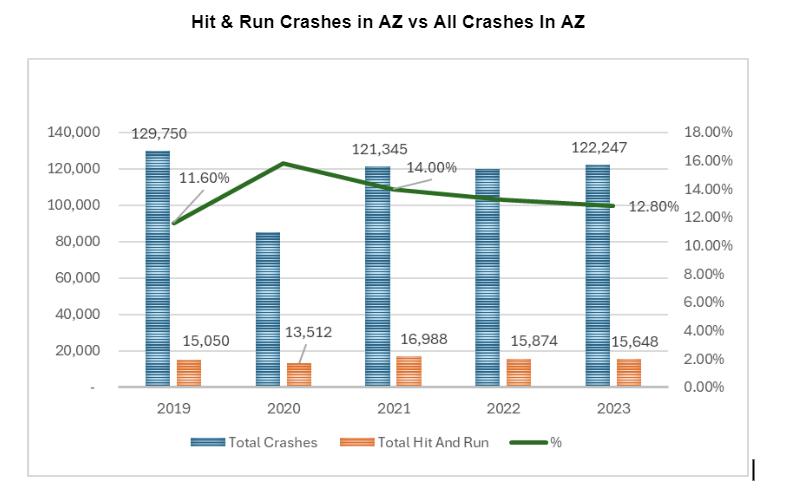

yearly trends of hit and run accidents in arizona

Nationwide, hit and run accidents average around 11% of all traffic accidents. In Arizona, the number is 12.9% or on a percentage point basis, the incidence is almost 20% greater than the national average. Even more alarming are the trends involving the Arizona hit and run accident rate as its proportion is not back to pre-pandemic levels.

In 2019, the number of hit and run crashes to total crashes was 11.60%, which is roughly the national average. Then after the pandemic, the rate jumped to nearly 16% while accidents dropped and has hovered near 13% since. Given the influx of new residents, a reasonable assumption can be made that the number of accidents will continue to move to the pre-pandemic trend, but will the number of hit and run incidents? Well, according to the Insurance Information Institute, in 2022 an estimated 11.9% of Arizona motorists were uninsured.

Implications for auto insurance in Arizona

These are the unintended consequences of uninsured motorists.

1.More Uninsured Motorists

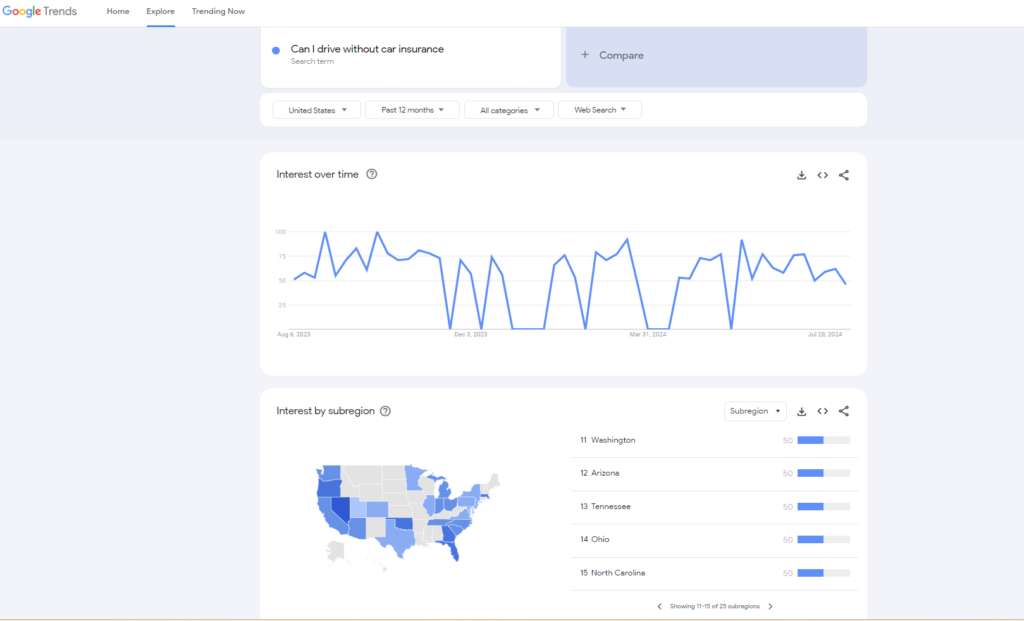

The Insurance Business Magazine reports that auto insurance rates will increase between 16% to 18% in Arizona in 2024. Combine an increase in insurance rates and increase in auto loan delinquencies (up 8.16% in Q4 2023) and it is safe to assume that more motorists will unwisely let their auto insurance lapse due to financial hardship. While significant, remember back in 2020, when the percentage of hit and run accidents grew from 11.6% to 16%? To determine if this worry is warranted, we went to Google Trends and asked “how many people are searching for ‘Can I drive without car insurance’. This is what we found:

Arizona ranks 12th nationwide. More uninsured motorists equate to more hit and run accidents and Arizona is NOT a no pay, no play state. We are an at fault state. So, if you happen to have an at fault collision with an uninsured motorist that causes bodily damage, the uninsured motorist can pursue damages from you.

What Should You Do?

Contact your insurance provider and examine the coverages you have on your current policy, especially as it relates to uninsured or underinsured motorists to determine if you have appropriate coverage. While unexpected rate increases are never pleasant, this can be an opportunity for you to obtain quotes from several insurers in the state. You may find that a slight increase in costs can give you much more coverage.

2. More Hit And Run Accidents

While the recent declines as of June 2024 in undocumented border crossings is a step in the right direction, those that previously arrived, adjusted and stayed will need to get around in our car dependent state. Since undocumented migrants are prohibited from obtaining a driver’s license, it is reasonable to believe that some will be tempted to operate a vehicle without a license since roughly 60% of them are employed, according to the Migration Policy Institute. In fact, over 273,000 undocumented migrants are in Arizona as of 2019 estimates and given the influx of additional migrants, we can only expect to see more uninsured motorists on the road.

WHAT SHOULD YOU DO?

Examine your situation closely and get the coverage you need. While we live in a state with less natural disasters than our neighbor to the west (California) and have abundant sunshine, there are automobile considerations that are specific to our state. One of them is ensuring that your automobile policies take into account the numbers of uninsured or underinsured motorists. We encourage you to speak to your insurance provider, examine the coverages you need with a keen eye on minimizing the impact of a hit and run accident by uninsured motorists.

Save time searching for auto insurance

To get an in depth auto quote that accounts for these nuances, it takes about 2 hours. With close to 200 licensed insurers in Arizona, it would take almost 2 months (57 days) working 7 hours a day to get quotes and find the best option. By working with a licensed agent, not only will you save an inordinate amount of time (56 days and 5 hours to be exact) but you will also be in a position to secure the right amount of coverage, peace of mind and receive topical information about changes in the insurance landscape.